As I am writing this note about Less-cash/Cashless India, the Indian media is reporting the great confidence in Prime minister Modi’s government, and the corporate community is showing high confidence in his leadership. The Prime minister’s office is claiming the reports to be a validation of the acceptance and success of the bold initiative of Prime Minister Modi: the decision on Demonetisation on November 8th, 2016.

Demonetisation, an almost revolutionary action, has become a big bonanza for the digital payments companies in India. All of the digital payments players have benefited in the 3 months since its introduction. PPI wallets, the most available digital payment product for the masses, have gained most handsomely, while the ‘new kid on the block’ – the UPI payment product – is consistently showing gains in adoption in terms of the value of transactions. Visa reported a gain of 75% growth in volumes of transactions on its payment products in India. But the challenge for the major card payment networks like Visa is that India has the lowest per capita Point of Sale infrastructure – limiting any cardholder’s ability to make purchases at physical locations. On the other hand, India has over a billion mobile phones, each of which are a potential payment device. The OLA Money app had a1, 500% growth in downloads in about 8 hours after the government’s announcement about demonetisation, while Paytm reported users increased its mobile app’s usage by nearly 600% in the first few days following the change. The BHIM app., launched only on December 30th, 2016 has seen downloads in excess of 17 million.

Our company – RS Software India – has been engaged in electronic payments for 25 years with the mission of helping our partners and clients enhance the economic circumstances of individuals, communities and countries through the transformative power of electronic payments. We have helped to build two major payment networks globally including VisaNet and India’s Unified Payment Interface (UPI). VisaNet moves over $9trillion in value of electronic payment transactions annually. UPI (Unified Payment Interface) and BBPS (Bharat Bill Payment System) – India’s core digital payment infrastructure – have the potential to enable payments over a billion mobile devices.UPI is technically a digital REST (Representational state transfer) API (Application program interface) based payment platform that makes mobile device based payment frictionless. UPI provides end-to-end security by encrypting information at source. The payment information is carried from device to UPI platform and UPI is able to invoke the right mechanism. Examples are IMPS (Immediate Payment System); AEPS, (Aadhaar enabled payment system). UPI exchanges information with UIDAI ( Unique Identification authority of India) for the AEPS flow. The frictionless aspect will perhaps be the primary enabler to make the transition to cash-less. The UPI, JDY (Jan Dhan Yojna) and Aadhaar – the 3 pillars of India stack – plus mobile penetration along with political conviction will drive the adoption. The open source and API technologies deployed in UPI platform and BBPS have democratised the payments building eco-system in the country. These platforms provide app developers and banks an opportunity to drive payment innovation and foster inclusion. McKinsey has estimated a global spend of $4 trillion between now and 2025 to transform the world to a digital economy. India needs a huge effort to build its own digital payments eco-system, and herein lies an opportunity for entrepreneurs to leverage the power of UPI and BBPS platforms, and build the next set of Unicorns that will power the move to less-cash society.

Demonetisation, an almost revolutionary action, has become a big bonanza for the digital payments companies in India.

However, what also appears to be true is that cash is not going to be dying anytime soon. Even in a developed country like United States, as per a report prepared by Federal Reserve Bank of San Francisco, cash usage continues to be resilient and is used extensively by both older Americans as well as young “millennial” Americans. Approximately 32%of transactions with over $1 trillion in value are estimated to be completed annually using cash. Families earning less than $25,000/year in the US make almost 48% of their transactions in cash, while those earning between $25,000 to $ 50,000/year use cash for 33% of the transactions. By the year 2020, the US GDP is estimated to reach $22 trillion with the share of cash for payments estimated to be nearly 12%, exceeding $2.5 trillion. Much as it may sound strange, technology is in fact helping to create more efficient ways to use cash in more places in US. The reason is that the role of technology is to help consumers and businesses to achieve what they want to, and cash continues to be a highly preferred payment method, particularly for “small ticket” transactions up to $25 in value, and by the younger millennial generation in particular.

India

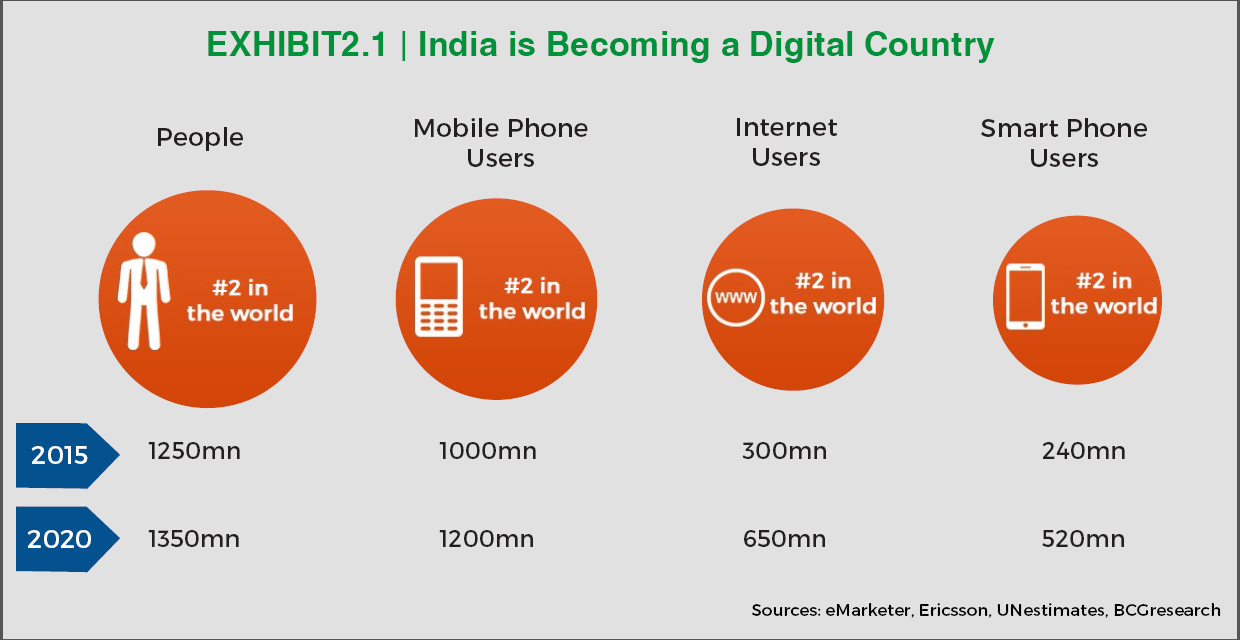

India’s total number of Internet users is now higher than in the United States, with a rapidly growing smartphone population. This large market opportunity is attracting huge investments in “fintech” opportunities, helping to accelerate India’s potential for alternate payment products.

Below I’ve listed both the positive influences that are helping to drive the growth of electronic payments in India as well as some of the challenges ahead.

Positive Influencers

- Prime Minister Modi’s personal “demonetisation” push for digital payments adoption

- Favourable regulatory environment

- NPCI’s initiative in building a new digital payments infrastructure, UPI and BBPS, built by RS Software India Limited.

- An ecosystem of stakeholders who will take advantage of and grow the usage of digital payments: Telcos, banks, payment banks, wallet providers, ecommerce sellers, online marketplaces, entrepreneurs building on India’s new digital stack, along with the established IT industry

- India’s 1.25 billion population, youngest country in the world with keen interests in technology

Challenges

- Poor acceptance infrastructure, particularly for traditional card-based payment methods

- Less than five percent of merchants being digitally enabled

- Pace of evolution from India being primarily a cash society (over 90% cash payments)

- Lack of a clear value proposition for digital payments over cash for all stakeholders

- Regulatory system needs to be market driven and responsive to the needs for change

- Ongoing perceptions that cash is ‘free’ while digital payments have a cost

- Users find making digital payments to not be user friendly

Much as it may sound strange, technology is in fact helping to create more efficient ways to use cash.

The good news in India is that the recognition of the opportunities is fast gaining ground.43% of the investments in fintech are in payments. All of the stakeholders in payments are committed to solve the challenges – with strong leadership coming from the government. At a recent fintech valley spring conference in Vizag, the chief minister of Andhra Pradesh, Shri Chandra Babu Naidu, said “Andhra Pradesh government is aiming to develop Vizag as national and global hub for fintech innovation. Fintech Valley Vizag is Government of Andhra Pradesh’s flagship initiative that brings together industry, academia and investors to innovate, co-create and build the fintech ecosystem.”

All these initiatives point to a great foundation for India to move to a Less-cash society. According to several research reports, India expects a 10X growth in digital payments adoption over the next four years. Apps like BHIM and very many more emerging platforms riding on UPI core infrastructure; and RBI licensed bill payment operating units connected with the central BBPS are intended to bring about a new transformation toward achieving financial inclusion – significantly broadening the foundation for the Prime Minister’s vision of digital India. The Indian digital payments industry is now in a long-term secular growth trend, and offers the most promising entrepreneurial opportunity for young India.

1 comment

I have noticed that your blog needs some fresh content.

Writing manually takes a lot of time, but there is tool for

this time consuming task, search for: Wrastain’s tools for content