Photo by Shane Rounce on Unsplash

The year 1992 will long be remembered in the economic and political history of India. Driven by the abject failure of its decades-old socialistic policies, the Government was constrained to change direction and roll out economic reforms, which have since lifted the country to high growth and reduced poverty trajectory. The reform package included (a) abolition of the Licence Raj, thereby freeing companies from the need to obtain Government approval for any capacity addition, (b) removal of import licence requirements, thus allowing unrestricted imports of almost all items, (c) drastic reduction in protective tariffs – in the case of chemicals from 135% to less than 10% over a few years, (d) freedom to import technologies and equipment, (e) eligibility for foreign companies and large industrial houses to invest in most sectors without restrictions and (f) freedom to raise capital through stock exchanges, based on market-determined valuations.

While these reforms were hailed as progressive and long overdue, there was a section of existing Indian industry, led by “Bombay Club”, which felt that its very existence would be in jeopardy since, without a significant adjustment period, it was being shifted from a highly protected regime, with its inherent inefficiencies (which arose from the Government’s own past policies) to the onslaught of full-fledged international competition from large efficient companies having deep pockets, without a level playing field being provided.

These fears were not unfounded and many companies from the pre-liberalisation era could not survive the transition, falling to the theory of Creative Destruction, enunciated by Economist Joseph Schumpeter.

It was the Audacity of Hope, that we would jointly overcome the difficult periods, that kept the company (which some had written off) running while most of its contemporaries perished.

In late 1992, while “old industry” was still recovering from this shock, I was invited by the Board of Directors of the chemical company I was associated with, to take over as its Managing Director. The company was in a serious liquidity crisis on account of three major investments made right towards the end of the pre-liberalisation era, which were consequently facing the full brunt of the economic reforms. It was like being appointed Captain of a Ranji Trophy team, without any orientation, and to be told that the same team would now play in a completely different arena – international cricket representing the whole of India, instead of playing in the local league, and in all formats: T20, ODIs and Test matches.

The company had about 750 employees and an equal number of others it supported, including contractors, transporters and miscellaneous stakeholders. There was thus the responsibility to a large number of families, apart from suppliers, customers and shareholders, for business continuity.

All the past practices needed to be reviewed and new strategies drawn up for speedy execution. The one constant factor during this entire transition, and my subsequent tenure of 16 years in this capacity, with continued challenges, was Hope. It was the Audacity of Hope, that we would jointly overcome the difficult periods, that kept the company (which some had written off) running while most of its contemporaries perished. Survival not only placed it on a firmer foundation but also allowed it to grow, thrive, acquire new sites and enter international markets in a major way.

This is a brief account of a few of the many challenges faced and how they were overcome with the firm belief that whenever one door closed, there had to be another which could be opened.

Product Portfolio

While it was regarded as a large company in its product categories in India, when benchmarked against international competitors, it had just a fraction of globally recognised capacity and neither upstream nor downstream integration. To overcome the handicap of economies of scale, the company undertook a major strategic exercise, identified several downstream specialties, developed processes in-house or acquired foreign technologies, executed projects and became an integrated player.

International Presence

The new plants set up had to be globally competitive in cost, size, efficiencies and quality. As markets in India would take time to develop, the initial surplus capacity had to be placed in other Asian (and even European and American) markets, using export as a flywheel. For a relatively small company (by international norms), it was a challenge to set up distribution networks in individual geographies, without having local staff, offices or warehouses, which were clearly not affordable. Even establishing a new brand needed substantial effort, which was regarded as long term investment. One approach adopted successfully was that of international alliances. We were able to identify a very large German company (which is a household name even in India) and set up a joint purchase – sale – formulation alliance which became very successful for both since it was designed to meet the unmet needs of the two partners.

International Ownership

The transformation of the company from the earlier avatar to one which could withstand global competition, needed substantial capital, which the then majority stockholders in India were unable to bring in (being a large group which faced similar requirements in its other companies as well). I was then asked to identify a possible new owner who could bring the needed capital. The search resulted in a US multinational corporation with a synergistic product line showing keen interest and eventually taking up majority ownership, bringing in its wake several advantages which were relevant in the international arena. It was a true “win–win” alignment of forces. It is to the credit of IIT Bombay that coincidentally the leader of the team on the other side, who negotiated the entire deal, was my batchmate from IIT and this made the transaction smoother and quicker.

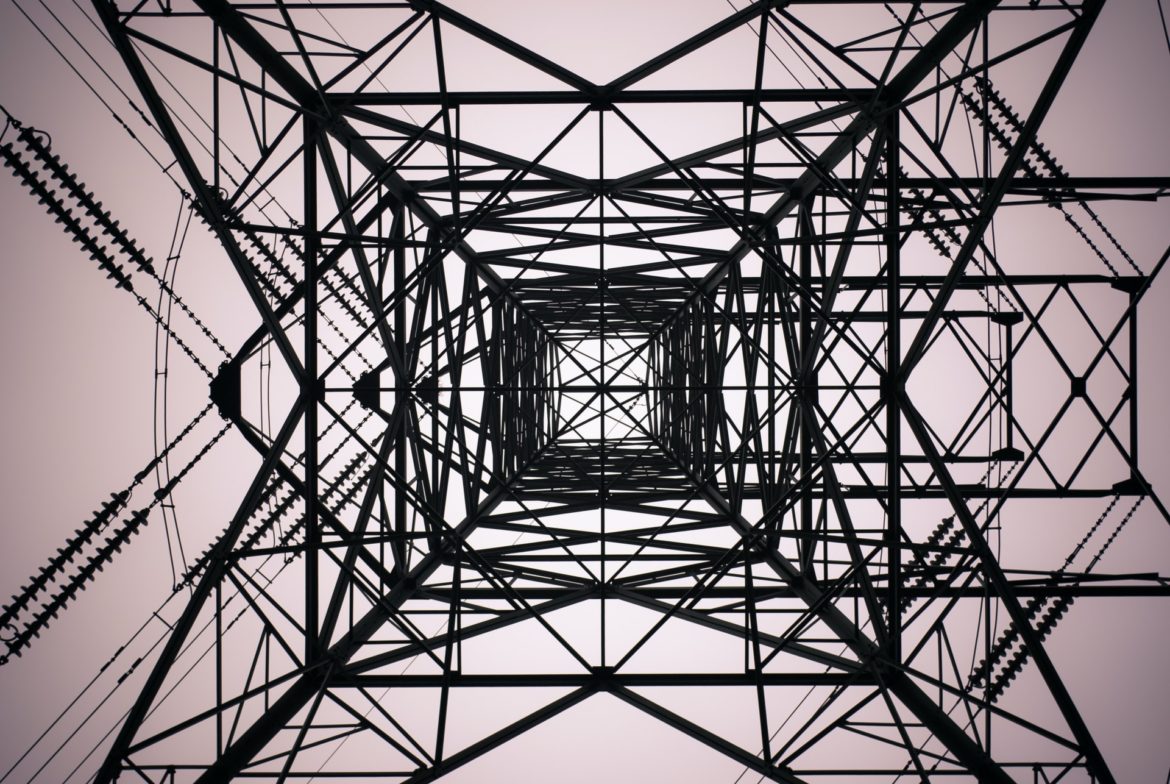

Continuous Power

Though the company’s plant was located in a metropolitan area, in an estate dedicated to chemicals, there were about 55 power interruptions in a year, due to the weak infrastructure of the State Board. For continuous processes, each outage or trip is highly detrimental and this large number was certainly not acceptable when viewed against our international competitors who could not recall a single outage in over a decade! With the freedom to import equipment, we sourced a 5 MW gas turbine and a heat recovery steam generator from the USA to have a very reliable captive cogeneration plant, combining sound engineering with economics.

Process Intensification

With the help of mathematical modelling and various engineering optimisation approaches, each plant, process and major equipment was subjected to detailed study to maximise its productivity. Newer catalysts, debottleneck studies, change in distillation column packings, recovery of byproducts from effluent streams, energy optimisation were a few of the approaches which resulted in capacity and efficiency enhancement from existing old assets with the least capital expenditure.

Raw Material Sourcing

The company’s manufacturing facility was conceived in the 1960s as being downstream to a petrochemical cracker located in its proximity. However, the cracker, from which the major raw materials were sourced, itself became a victim of the economic reforms and ceased operations. There were no nearby facilities which could completely substitute this source. Alternate sources were located almost 1000 km away, in Northern, Southern and Eastern India. Moreover, the raw materials were hazardous to transport, especially on Indian roads, and needed special tankers. As GST was not even at a conceptual stage, crossing State borders added to turnaround time. The urge and hope to continue operations despite the closure of the principal supplier of feedstocks resulted in multiple other sources being developed with elaborate logistics infrastructure and quality measures, to bring in thousands of tonnes month after month over these long distances

New Sites

The multinational company, which became the major shareholder, had two other sites in India, which were both consistently in deep red, with no visible prospects. It was contemplating their closure, to save the mounting losses. After studying the business models, we proposed the acquisition of these sites and a merger with our company with a one-year target to turn them around. With a robust strategy in place, these were indeed turned around and are today among the best sites of the MNC.

To conclude, this is a brief account of just a few of the many measures drawn from a company’s survival kit. It would illustrate that a combination of sound Engineering, Economics and Strategy, driven by Hope and supported by Teamwork (plus, of course, IITB education!), can help in converting many difficult challenges into major opportunities.

2 comments

Hi Rajeev,

An extremely well written report documenting the decision making and problem solving skills of Engineers in top management positions. And an apt reminder that it is the Audacity of Hope that keeps one going on & on braving the headwinds.

Hi Sir!

A well-articulated document and happy to be part of the turnaround under your leadership for 6 years

Jagadeesh

SJMSOM, IIT Bombay Alumni