[This article was written on March 15, 2017.]

Since taking over the reins of the Government, Hon’ble Prime Minister of India Shri Narendra Modi has taken several steps to create ease of doing business and has also ensured that infrastructure creation goes on at a fast pace. Several countries from Japan to UAE to Saudi Arabia have shown keen interest in investments in India, some of which are now going to go on to the implementation stage, like Mumbai Ahmedabad High Speed Bullet Train, Mumbai Nhava-Sheva Sea link and Smart Cities.However, several of the government projects such as Smart Cities are not able to take off due to lack of funding available for them.

Most countries providing assistance at large scale want to have sovereign guarantees, or deal with only government entities to receive implicit repayment guarantees of converting the same into a government debt at a later date. The private sector of India has not been able to get funding for infrastructure projects from other than PSU Banks for a variety of reasons. Many of the private sector infrastructure companies are now saddled with huge assets at even more inflated valuations, which make them and their projects unattractive for new buyers, or disable them from raising funds to complete the existing projects or raise funds for additional projects. This has created a log jam in the system with frustration growing at every level about how to kick start the projects and create additional jobs in every sector.

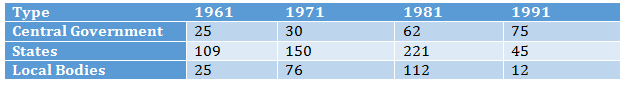

History of States and local body Bond issues on the BSE (1961 – 1991)

As seen in the above table, it is clear India has a history of vibrant trading in bonds up to 1980’s. There has been a massive dip in terms of bond trades in the 1990’s. This is attributed to various reasons, namely misuse of the exchange platform, and credit risk which could not be accounted for in the regulatory framework at that time.

Infrastructure Funding in India

In the two decades since 1997, close to 30 municipalities had raised a total of Rs 1,353 crore via taxable bonds, tax-free bonds and pooled financing. Typically, investors in these instruments were institutions including insurers, such as Life Insurance Corporation, public sector banks and a couple of mutual funds. The largest of the offerings was Bangalore Municipal Corporation’s Rs125 crore bond issue in 1997 which was guaranteed by the state government at that time. Since then, other cities also accessed the capital markets through municipal bonds (without guarantee), including Nashik, Nagpur, Ludhiana, and Madurai. In most cases, the proceeds were used to fund water and sewage schemes or road projects. The last issuance was done by Greater Visakhapatnam Municipal Corporation for R30 crore in 2010. Later on, for a variety of reasons, these Municipal Bonds were no longer raised from the markets.

Conceptual suggestions on structuring of Infra project in two parts – Implementation and steady state

As of today, there have been multiple financial sector reforms, both from market microstructure and from regulatory perspectives. Attempts are made by the regulators and the market participants to generate increased investor awareness, especially regarding risk and return of various financial products. India is the fastest growing global economy; its GDP is expected to reach USD 2.4 trillion soon. India will require more than USD 2 trillion for improving its infrastructure over the next 7 to 10 years. This means Indian infrastructure will require close to USD 200 billion per annum for next 10 years. Similarly, for other industries and services companies, an additional USD 50 billion per annum needs to be raised. The total fundraising requirement may, therefore, be USD 250 billion per annum.

Infrastructure fund requirements will be long-term (from 10 to 20 years). The investors will also have similar long term requirements of funds. Pension funds and insurance companies are ideally suited for the purpose. However, they will not want to take project risks, since their style of investing is annuity based.

The current situation means that the Government department or Government Infrastructure companies may be required to raise funds for short term projects of 1 or 2 years, till implementation, and then sell it to private sector special purpose vehicles for long term annuity based investments. The transfer mechanism and even pricing can be determined at the time of launching the project to avoid any ambiguity later. There is also a possibility that the project may be able to get some bridge or short term financing from the long term investors with credit enhancement coming from some of the special purpose agencies.

This will ensure that Government department or respective PSUs will be responsible for creating end-to-end cleared viable infra projects, and implementing them using international or local contractors, funds for which will come from the third party lenders for the project duration. On completion of the project, the money will be realised from new sets of investors and the completed project handed over to the new investors for the long term as per the contracts. The money realised along with profits in one project completion can be used in subsequent projects, recirculating the money. This proposal will take away the concept of project risks from the private sector, and also the requirement for long term funding for infra creation.

The micro-regulations at each level, from municipality to state to central, need to be updated fast to ensure ease of doing business, and for the projects to come up faster. On the other side, current viable projects which have been stalled for lack of funds, and the inability of current private sector promoters to bring additional funds, need to be sold to newer buyers along with the existing loans etc., using the Bankruptcy Code framework within a short time frame.

Raising of Funds and Availability of Funds

India’s GDP is expected to reach USD 2.4 trillion in the near future. Currently, India saves close to 30% of its GDP, which works out to USD 720 billion. Over 10 years, the savings by Indians will aggregate to USD 10 trillion if we assume a growth rate of 7% per annum. Total estimated requirement of funds for infrastructure is USD 2 trillion and others USD 0.5 trillion during this period. Total requirement therefore for 10 years works out to USD 2.5 trillion. This means that if we are able to harness local savings, we may be able to fund the entire requirement domestically, which will require only 25% of the total savings we as a society will be making over next 10 years. If we are able to attract even half of it from domestic sources, the balance half will be easy to raise from foreign resources. It will mean only 12.5% of Indian savings will be required for funding of Infrastructure and Industry.

To achieve this, several questions need to be answered. How do we attract local individuals and others to invest in Indian infrastructure and Indian businesses? How do we create soft and hard Infra required for raising these resources? How do we untie the same from sovereign guarantees so that the investment takes place on a prudent commercial basis and market-related product checks and balances are available?

The current implementation of the Insolvency and Bankruptcy Code could go a long way towards implementing a soft infrastructure which gives confidence to the lenders. The Indian judiciary and police system will also have to be made more effective in implementing the bankruptcy framework. From the current “lenders beware” perspective, it will take India towards a “borrower beware” framework, making the lenders feel more comfortable to lend. Our banking and other lending institutions would then be willing to lend to more projects and companies as compared to today. In addition, the move towards financial assets will happen if people become comfortable that their money comes back, or that they have a quick and effective remedy.

Corporate Bond market perceptions, needs and concepts

Recently, the prudent framework has ensured that projects and companies want to borrow in Indian rupee denominated bonds instead of foreign currency bonds, even from foreign markets. This framework is called “Masala bonds”, for which withholding tax has been kept at 5% for foreigners. Indian investors pay a much higher tax in comparison. Overall, it is estimated that less than USD 2 billion[1] has been raised by Indian issuers within this framework, using London and Singapore.

There is also a perception that bond markets abroad have huge liquidity and investors are able to sell or buy huge amounts of bonds at will and in a short time. The reality is that even in the USA, the annual trading value to amount of bond outstanding ratio is 0.9%. In India, this ratio is 0.2%, which is not very far off, and both American and Indian numbers are quite low anyway in terms of trading of bonds.[2] Masala Bonds currently listed on the London Stock Exchange and Singapore Exchange are also not known to trade regularly.

In Indian markets, the fragmentation of bond markets between RBI regulated entities and others is one of the larger reasons for lack of liquidity, in addition to very restrictive regulation in general. In comparison, even a relative newcomer like China has several times larger debt markets and more liquidity. Many more actions can be taken to improve trading and liquidity in Indian bond markets going forward.

Investors invest in good bonds for long term and not for trading. They may desire liquidity but may not participate actively to provide liquidity. In essence, the investors, small and large, are consumers of liquidity. For providing liquidity, we may have to create a market-making framework. In absence of liquidity, the investors may ask for a slightly higher interest rate which is called “liquidity premium”, if they are sure of the money being returned on maturity, or sufficient collateral is available which can be acquired and sold to recover the money invested within a reasonable and predictable time frame.

Recent developments in Indian Bond markets

Between April 1, 2016, and February 28,2017 in current fiscal, Indian privately and publicly placed bonds have raised Rs 6.8 lakh crores (~USD 101 billion). Out of this, more than Rs 3.2 lakh crore (~USD 50 billion) consists of bonds listed on BSE. More importantly, the BSE Bond distribution platform has been used to raise more than Rs. 1.7 lakh crore (~USD 24 billion) of bonds via private and public issuance.

Although Masala bonds have caught the imagination of the policy makers and media for a variety of reasons, BSE alone has raised 20 times (2000%) more money for Indian corporates in this fiscal year, as compared to Masala bonds. With an effective implementation of the Bankruptcy code, and a few more procedural changes, our understanding is that Government of India backed entities can raise somewhere between USD 100 billion and USD 200 billion from the Indian public each year, which will drastically reduce the need for the sovereign guaranteed foreign currency (government to government) Infrastructure loans or private sector foreign currency bonds.

For this market to come up and become vibrant, we will require offerings of bonds of commercially viable projects, commercial accounting, and commercial management in special purpose vehicles created to earn income and have sufficient assets to repay the debt.

Recently, Dewan Housing Finance Limited (DHFL) raised bond funds to the extent of Rs. 14,000 crore in public issue of bonds. First, they raised Rs. 4,000 crore on 3rd Aug 2016 at a maximum rate of 9.3% (10 year) and on 29th Aug 2016 they raised another Rs. 10,000 crore at a maximum rate of 9.25% (7 years). At that time, Government infrastructure bonds were trading at 7.5% yield for similar maturity. If DHFL can raise such large amounts in a short span of time, Railways or NHPC or NTPC or Pune Municipal Corporation or any other Government credit enhanced entity can raise a much larger amount of funds.

Additionally, Indian rupee denominated corporate bond funds (index funds) can also be considered for implementation, so that the liquidity required for an investor is available to them at a very low fund management cost, and at the same time the risk gets diversified over a larger portfolio. Pension funds and Public Provident Funds may also be allowed to invest in such bonds or index funds. They can also be made eligible as SLR securities.

Overall recent development and the effect of demonetisation, as well as other steps taken by Government of India, should be used to get more people involved in formal financial markets in low-risk Government-backed instruments giving reasonable returns on par with banks or slightly higher, so that the Government’s priority projects are implemented. The total amount of money thus raised by Government-backed entities can be in excess of USD 100 billion per annum without making a dent in the private sector borrowing. This will also take away people from dubious collective investment schemes like Sharadha, Pearl Agro, etc.

Incentivised selling commission to brokers selling these bonds, up to 2%, may bring in enthusiasm in the financial distribution community. The 2% commission, when distributed over 7 to 15 years, would work out to less than 0.20% per annum additional cost, which can also be counted in the overall cost of funds and will go a long way in distributing these safer products to the masses.

Experience in the Exchange Traded Platform to Raise Debt

In corporate debt placement, the parties involved are large corporates, mutual funds and sophisticated institutional investors who need the flexibility to negotiate terms of the issuance, for instance, whether to have arbitration or not. A sophisticated negotiated private placement market is preferred to public offers of debt securities. Parties already negotiate greater details than those sought to be introduced through the Electronic Book Mechanism.

To overcome these challenges, in 2016, BSE introduced greater flexibility and service levels in its platform, including a personalised demonstration for issuers and detailed assistance with the issue setup, which was done irrespective of location of the issuer. This set BSE apart from other players and gave BSE a clear edge in this sophisticated market, especially in the details pertaining to timing, yield details and arbitration.

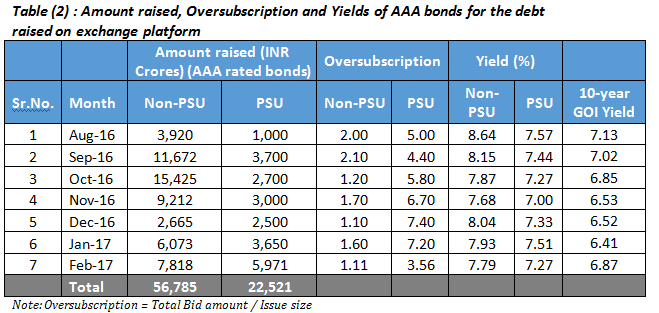

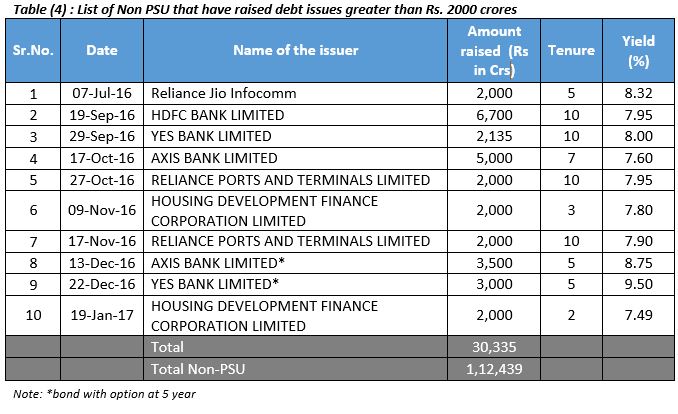

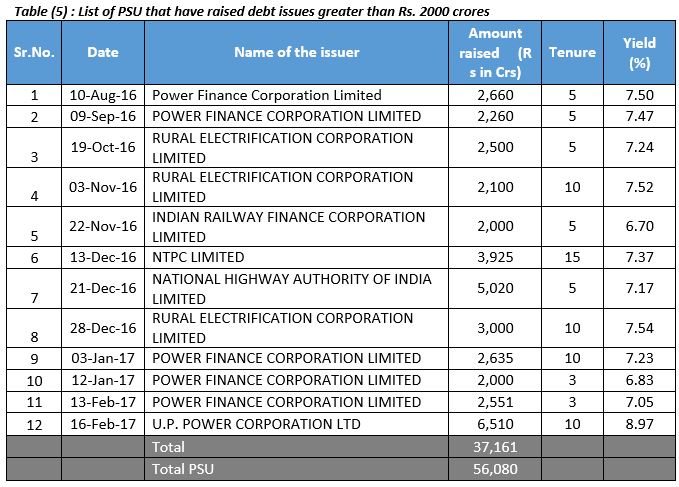

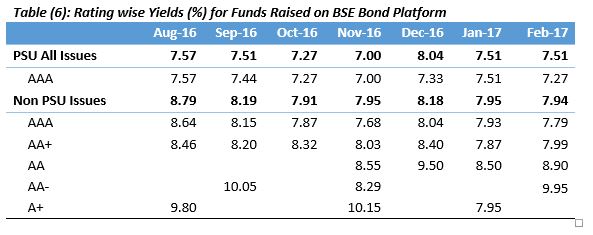

Market participants have found the BSE Platform to be user-friendly, easily accessible, robust and transparent. The earlier system forced the Issuers to issue the bonds at a particular price due to the information asymmetry in favour of select participants. The initiative of an electronic book building platform system by BSE which is simple to use, robust and dynamic to raise capital in the most cost effective and transparent manner has set benchmarks in the industry and helped issuers complete their issuances swiftly. Single issuers have been able to raise securities worth more than Rs 6500 crores (~USD 1 billion) in less than 4 hours from idea to fund-raising on BSE platform.The Exchange Platform has been used successfully by both the PSUs and the Non-PSUs to raise debt capital.

[1] Around Rs. 11341 crore, Source: Economic Times,27 Jan 2017

[2]Source: Crisil Report (Nov, 2016), “Are Stars Aligning for the Growth of Corporate Bond Markets in India”