Six world leaders hold an emergency summit at the Austrian Ski town to tackle an imminent economic meltdown.

Six world leaders hold an emergency summit at the Austrian ski town, Kitzbuhel, to discuss how the ISIS crisis, oil, commodities and China’s slowdown could drown the world in 2016 unless they jointly did something. They ended up merely sharing some data to justify what each one was up to. The Indian PM Modi, on his way back gets his advisor to explain to journalists on board his aircraft, what all that data that he got at the summit, really means for the world and to India in particular. 2016 will be a tough and volatile year, in which oil prices will drop further. At some point however, oil price will creep up. Some parts of the world would be worse off than last year, especially OPEC, Russia, etc. Disturbances would affect Latin America. The ME could be a tinderbox that could send oil prices up again. China will be in transition, not likely to lose its global market share but some domestic market ‘explosions’ will keep China in the news and the global stock markets on tenterhooks. This will affect India’s bourses as well despite the Indian economy pulling upwards because FDI starts finally kicking in, inflation remains under control and fortunately, decent monsoons and low oil prices help Modi to keep the GDP a little above the 2015 rate despite fall in exports. Who will the winners and losers be? Will speculators exploit the vulnerability of the situation to trigger a crisis? Read on for more.

[Disclaimer: This is a fictional story with real characters and the views expressed are entirely those of the author and not of the persons named in the story.]

The world had become an uncomfortable and fearful place not just for ordinary citizens but even more so for the leaders of nations. There is talk about war, terrorism reaching the most unlikely of places, a global crisis because of China’s slowdown, global stock market meltdown and an impending financial implosion due to huge debt burden led by the unprecedented crisis in commodities, and countless other unhappy thoughts, making 2016 a very worrisome year. The heads of state realised that the world was at a crossroads and that they had to pull together in the right direction. The leaders of some of the most populous countries decided to achieve that by meeting at a small Austrian ski-town called Kitzbuhel. The US, the UK (yet to decide whether they want to be in the EU or not), Japan, China and India got automatic entries. The US got Russia be tossed out. Since the heads of the five biggest countries in the EU were very busy due to their Christmas-New Year commitments, they opted to be represented by Jean-Claude Juncker, the President of the European Commission who would do an admirable job of providing dispassionate inputs and of carrying the message back to each member of the EU, not just to the Big 5. This group of ‘6 Intelligent men at Kitzbuhel’ on December 28, 2015 was aptly named, KI 6 for obvious reasons, and also because KI 6 happens to be the acupuncture point just below the ankle, which if pressed would rid the body of fear, and fear is what brought these six men together.

Each of them was required to present the key issues from their own perspective so that the common threads linking all of them could be treated as the world’s real problem to be solved. Obama was quick to explain that he down in the last year of his term. Since he wanted to leave his Presidency in a blaze of glory, he said he did not appreciate the crash in stock and commodity markets, followed by potential real estate price crash. Likewise, he wanted the Russian supremo, Putin, to be caged to bring peace to Europe (and increase fuel supplies from Russia too) by keeping the price of crude oil below $50 per barrel.

Jean-Claude wanted to know why $50 when many speculators were expecting sub-$20 prices; at which point, Obama referred to his iPad and rattled out the oil price at which each country’s national budget would just about get fully funded. Russia clearly needed $60 and if the price stays at below $50 long enough, there was even a possibility of Putin getting ousted. President Xi quipped that before that happens Putin will get terribly belligerent. Intervention in Syria is just the start.

Since the heads of the five biggest countries in the EU were very busy due to their Christmas-New Year commitments, they opted to be represented by Jean-Claude Juncker, the President of the European Commission who would do an admirable job of providing dispassionate inputs and of carrying the message back to each member of the EU, not just to the Big 5.

The Indian PM, Modi immediately said that Putin may open more military fronts in oil producing countries not just to fight back but also with the intent of creating uncertainties in oil supply. That would automatically push oil prices up. Obama then remembered that he was under pressure from the Jewish lobby to raise oil price a bit, to protect the struggling US shale oil industry that pumped out nearly 5 million barrels of oil per day in 2015. Some shale oil companies are on the verge of economic collapse which could send shock waves in the US financial sector. After all, since shale oil helped US reduce its dependence on Middle Eastern oil, the shale oil industry and Junk bond holders wanted help to push oil price north of $45, preferably close to $65 in 2016. If the shale oil sector collapsed due to unaffordable oil price, it would cause a shift in the US stance towards the Arabs. Obama had assured the lobbyists that they had nothing to fear because the Saudis may reduce oil supply since he had offered to invest in Saudi Arabia to help it diversify its oil dependent economy, when King Salman visited the US in September. David Cameron pleaded that, the US should talk quickly to the Saudis about reducing oil production to 9 million barrels per day which would suck out some surplus oil from the market. That would save the US shale oil industry (and what he left unsaid was that the UK had issued 93 licences for 159 onshore blocks, just before Christmas, to explore for shale gas/oil and coal bed methane. He desperately needed them to become viable). “No” said President Xi, whose country’s slow-down in 2015 was cushioned to a great extent by cheap oil. Looking at Obama, “My country carried the burden of the world’s growth for the past 15 years and at the start of that cycle the price of oil was only $23 per barrel. Even after taking into account inflation, there is no justification for more than $50 per barrel”. Modi smiled because he was saved the need to resist the UK suggestion. But he decided to add his spin to it. He was against oil price hike at this stage because a $30 per barrel increase would make the ISIS richer by $16 billion per year which they will happily spend to hit Western and probably, Indian targets. Further, the UAE and Saudi leaders whom he met in2015 had urged him to influence world leaders into not letting Iran open its oil spigot (potentially 2.5 million barrels per day) which would double the global oil surplus. ‘No market share and no price rise benefit for Iran’, the GCC demanded.

Xi then told Obama that if USA were not greedy to earn more than $30 billion each year by exporting arms, the world would be a better and safer place, and oil prices would be at a price that is fair to producers and users. Also if the Western world’s financial wizards were to not indulge in speculation, not just oil but all commodities, would be in the market at a fair price. In fact, speculators, according to Xi are the biggest challenge to be addressed by the KI 6.

He was against oil price hike at this stage because a $30 per barrel increase would make the ISIS richer by $16 billion per year which they will happily spend to hit Western and probably, Indian targets.

An annoyed Obama said that he would like the others to explain their problems. The noncontroversial but adventurous Abe stood up, bowed and then explained that Japan’s basic problem of ageing population, etc. cannot be solved by the world and half seriously, enquired whether the world could at least consider exporting some inflation to Japan. “My country has an ageing population, low domestic demand and a huge debt mountain. My country’s situation is such that a mere slowdown in exports in 2015, especially to China has almost derailed my plans to coax Japanese companies to increase wages in Japan. I need to reflate the Japanese economy. Hence I don’t want any discussion today on the bad impact of QE in Japan on the global economy. I need to QE or negative interest rate for a while irrespective of what you gentlemen may have to say about the debt-led global crisis.” President Xi assured Abe that he will send Wang Yang, his Vice Premier in charge of economic relations and trade very soon in 2016 to start a dialogue to increase trade but also talked obliquely about the need to sort out the old wound, the ‘comfort women’ issue. A relieved Abe agreed to meet Wang personally in Tokyo.

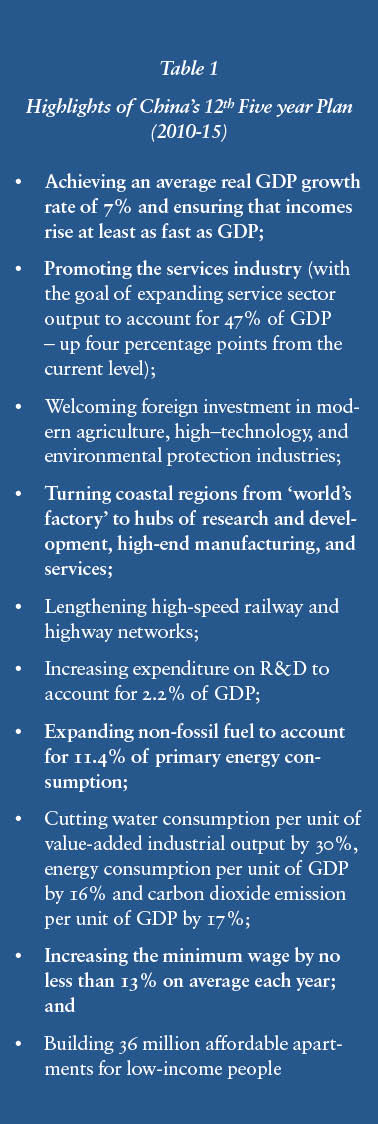

Modi piped in and offered to make it easy for Japan to invest in India to manufacture products for the world. That will  also mean that India will import more from Japan in 2016. He reconfirmed his decision to get Japan involved in a massive investment in Indian Railways. He also explained steps to speed up Japanese investments in select economic corridors in India which according to Modi will be a win-win for both countries. It was now the turn of the visibly stressed Chinese President to explain the problems from his perspective. Since Xi knew that no one, not even his own Polit-Bureau trusted Chinese economic statistics, he decided to make his points with as few statistics as possible. The short term concerns that he was prepared to admit were, pollution, food price inflation, endemic corruption, high expectations of his citizens for a better life, etc. His Government was capable of handling them. Even the problem of ageing population will get sorted out in a couple of generations because the one-child policy has been done away with. He claimed that the reported financial mess that Chinese SOEs and Local Governments are in, were exaggerated (everyone knew that he was being economical with truth on the shadow banking crisis) and that the serious financial problems being faced, the periodic call for democracy, the Tibetan and Uyghur issues, etc. are part of the bigger Western conspiracy to prevent China from breaking into the league of developed nations in the next two decades. Xi emphasized that the US-inspired Trans Pacific Partnership (TPP) is primarily aimed to group various Pacific-rim countries that account for 60% of the world trade against China. “We have, for far too long, picked up the crumbs from the rich man’s table. No more of that, gentlemen”. Turning to Jean-Claude, he said that China was prepared to even part- fund his ambition of re-industrialising the EU with Euro 300 billion of investments. That settled it for the former Prime Minister of Luxemburg and current EC Chief who needs this promise to be fulfilled for Left support in the EU parliament during his 5 year term. That China fuelled the economic growth of the West for the past 15 years is a fact. Xi clarified to the KI 6 that while China’s growth has slowed down a fair bit, it has happened by design. He gave a hand out (see Table 1) about China’s 12th Five year Plan (2010 -2015) which clearly stated that they wanted the average GDP growth rate during this period to be only 7 % starting from a double digit rate in 2010. It is hardly surprising that the growth rate in 2015 is probably sub -7% (the actual being lower than the official estimate of 6.8%). Wage inflation was not a surprising consequence but a stated objective of the plan. So also was the conversion of much of SE China from the ‘factories of the world’ to ‘high end manufacturing and R&D Centers’.

also mean that India will import more from Japan in 2016. He reconfirmed his decision to get Japan involved in a massive investment in Indian Railways. He also explained steps to speed up Japanese investments in select economic corridors in India which according to Modi will be a win-win for both countries. It was now the turn of the visibly stressed Chinese President to explain the problems from his perspective. Since Xi knew that no one, not even his own Polit-Bureau trusted Chinese economic statistics, he decided to make his points with as few statistics as possible. The short term concerns that he was prepared to admit were, pollution, food price inflation, endemic corruption, high expectations of his citizens for a better life, etc. His Government was capable of handling them. Even the problem of ageing population will get sorted out in a couple of generations because the one-child policy has been done away with. He claimed that the reported financial mess that Chinese SOEs and Local Governments are in, were exaggerated (everyone knew that he was being economical with truth on the shadow banking crisis) and that the serious financial problems being faced, the periodic call for democracy, the Tibetan and Uyghur issues, etc. are part of the bigger Western conspiracy to prevent China from breaking into the league of developed nations in the next two decades. Xi emphasized that the US-inspired Trans Pacific Partnership (TPP) is primarily aimed to group various Pacific-rim countries that account for 60% of the world trade against China. “We have, for far too long, picked up the crumbs from the rich man’s table. No more of that, gentlemen”. Turning to Jean-Claude, he said that China was prepared to even part- fund his ambition of re-industrialising the EU with Euro 300 billion of investments. That settled it for the former Prime Minister of Luxemburg and current EC Chief who needs this promise to be fulfilled for Left support in the EU parliament during his 5 year term. That China fuelled the economic growth of the West for the past 15 years is a fact. Xi clarified to the KI 6 that while China’s growth has slowed down a fair bit, it has happened by design. He gave a hand out (see Table 1) about China’s 12th Five year Plan (2010 -2015) which clearly stated that they wanted the average GDP growth rate during this period to be only 7 % starting from a double digit rate in 2010. It is hardly surprising that the growth rate in 2015 is probably sub -7% (the actual being lower than the official estimate of 6.8%). Wage inflation was not a surprising consequence but a stated objective of the plan. So also was the conversion of much of SE China from the ‘factories of the world’ to ‘high end manufacturing and R&D Centers’.

Xi added that wages would be made to double in the next 5 years in order to attain inclusive growth. This got Modi thinking about what he needs to push for in India.

He extended an olive branch to Obama to work together on improving bilateral trade relationships and Chinese investments into the US. What he really wanted was protection from being shorted by speculators.

Juncker shared the EU’s belief that Europe would perform a shade better in 2016 but he clearly outlined the challenges posed by refugee influx and the fact that relief policies were getting stunted by the popular notion that opening the gates to refugees makes it easier for terrorists to slip in. The KI 6 discussed many more issues but did not agree on the problems that need to be tackled collectively nor even whether there is an immediate credible threat to the world because of some economies being driven to the ground by speculators; hence no strategy to deal with the impending crises was discussed. The leaders agreed to meet again before spring when things could be clearer.

The on-board briefing

Prime Minister Modi’s team had poured over the reams of data presented by the KI6 and had prepared a comprehensive briefing note. Modi informed the journalists accompanying him back to India that he and his economic advisor would answer only the following relevant questions that his team had selected from the many that were posted by them, and that would pretty much cover all that needs to be discussed.

- Will the oil prices dip below $20 per barrel and will that make the world a better place?

- Will the Chinese economy collapse as is being feared by many

- Will we see a global financial crisis again?

- What will happen to the US and Europe in 2016?

- How will all this impact the Indian economy?

Will the oil prices dip below $20 per barrel?

“I don’t know whether the oil price decrease will make the world a better or worse place, but the oil price will impact the global economy”, said Modi. He went on to explain that no one can predict the exact oil price but it is clear that even as the New Year dawns, there will be a further dip. But soon, he realised that it would be improper for a PM to get into the specifics because of the sensitive polemics associated with oil prices.

Dr Z, the only non-government member of Modi’s team took over and explained that the views he is going to express are his own and not that of the Government.

He was sure that the current sentiment of economic stagnation and the Saudi desire to retain its market share will ensure surplus supply. The almost certain lifting of sanctions against Iran in January, will also cover up the likely fall in shale oil production in the US at the current low oil price levels. It will also make it possible for Iran to weather its budgetary shortfall because of the likely unlocking of nearly $100 billion of Iran’s legitimate wealth stuck due to sanctions. The price drop might happen immediately in January and there are many who predict oil price below $20. If that happens there will be a huge reaction in countries that cannot sustain themselves at those prices. Russia, many ME oil producing countries, Nigeria and Venezuela, etc. will get hit hugely because their national budget at the current level of expenditure requires oil prices to be North of $100. Iran needs $87 but can manage for a while. Algeria and Libya which require a price of $96 and $269 respectively are big problems brewing very near Europe. They could be the next big trouble spot because there is not much their Governments can do. Russia needs a price of $60 per barrel and without that Putin will have to cut back on Government spending only to register the second year of negative growth. Saudi Arabia, the rich boy in the suffering lot, needs a $106 price to balance its spending, else will have to cut its 2016 Budget (already announced) and sell more of its Sovereign Reserve, dilute its holding in some of its crown jewels like SABIC, ARAMCO, etc., cut down subsidies on petrol, gas, water, animal-feed, etc. to keep its deficit manageable. But by some of those unpopular moves, it could be setting itself up for exploitation of Saudi citizens’ sentiments by the ISIS which wants to ultimately wield power in the land of the two Holy Mosques. ISIS wants high oil price because it is dependent on oil that it ferrets out of Iraq to fund its war on the world.

“Will a further oil price dip make the world a better place? For some yes, but not for the locals and expatriates working in the ME if construction and infrastructure building slows down as it did in 2008. Indian workers may have to head home. Imposition of new levies like corporate income tax in some guise or form, in not just Saudi Arabia but in many parts of the Middle East is likely.

Since Xi knew that no one, not even his own Polit-Bureau trusted Chinese economic statistics, he decided to make his points with as few statistics as possible.

In some OPEC countries there could be attempts by locals to destabilise their Government. For some actors, it would be imperative to disrupt oil supply, start wars and create unrest in the oil producing region to push oil prices up. This situation is cut out for the press to conjure interesting scenarios. It is my personal view that for these reasons, oil prices will rise again sometime during 2016 or early 2017 but the average price for the year will still be low enough to favour oil importers, like China, India, the EU, etc.”.

Will the Chinese economy collapse?

On China, Dr Z said confidently, “China will not collapse and that it is just an economy struggling in the transition from investment-led growth to consumption-led growth which has never a predictably smooth glide path. Personal consumption will not rise fast enough unless somebody puts money into people’s pockets.”

He said, “China will soon announce its 13th Five Year Plan in which you will see its intent to double wages between 2015 and 2020.The Polit-Bureau is aware that it has to convert China from the factory of the world for low cost production of toys and lingerie to a hi-tech manufacturing country with a strong R&D base (since the Western world will be in no particular hurry to supply the much needed intellectual property). China will continue to further push the share of services in its economy, as it did in the 12th Five Year plan to increase the share of services in its GDP to 48% in 2015 at the expense of the share of manufacturing. The obvious reason is that pollution levels had become unsustainable because of the old type of manufacturing. The overall sentiment in manufacturing reflected in the sub 50 manufacturing PMI is related to this and the drop in demand for exports to the global economy. “Let me tell China watchers who missed the details that China’s share of exports actually increased in 2014 and 2015 despite drop in actual exports. There will be a slowing of growth rates to below 7% or even 6% for 2 or 3 years. In the meanwhile, their Government is encouraging their manufacturers to not only go up the value chain but also move their labour intensive manufacturing to other countries. If India Inc. gets its head together, it may be possible to buy non-polluting manufacturing plants at low prices.”

Is another global financial crisis in the offing?

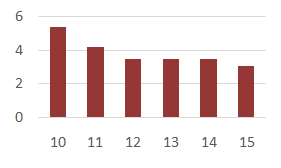

Total GDP Growth (IMF)

“According to the IMF, 2015 was the worst year for global growth since 2010 (Table 2).

They, the World Bank and several economists expect 2016 to be unspectacular but a tad better but a few like the Royal Bank of Scotland feel that 2016 is likely worse than 2015. Most economists’ estimates are in the range of 2.6 to 3.2%. Those statistics don’t matter in a bi-polar world. The mood in the US and Euro zone is positive with expected growth rates of 2.5% and 1.7% respectively. Japan is still uncertain. Both, Japan and the EU, will do more Quantitative Easing or have negative interest rates to bolster their economies. Germany can expect to grow at 1.75%, France and Italy at 1.3%, etc. Don’t look at the world through the developed countries’ lens but understand it from the emerging markets perspective because in the last 5 years, they accounted for 56 percent of the global GDP (PPP basis) and 79 percent of all the global growth came from them. That will not just reduce in 2016, but there will be serious unevenness within emerging markets including some shocks. China’s slowdown should have been expected, according to President Xi. For long, China prevented the global economy from shattering through its insatiable demand for commodities and other goods but this time around, such help is not forthcoming. Hike in interest rates by the US will lead to more outflow of money from emerging markets which add to the misery of low commodity prices. Devaluation of the Yuan and strengthening of the Dollar will upset the best laid plans of emerging markets. China accounts for 25 to 50% of the exports of most African nations, about 33% for Australia, etc. There has to be an impact on them as also on the US, Germany, Japan, South Korea, Brazil and Malaysia whose annual two-way trade with China is between $100 to 500 billion each. Thailand, Brazil and South Africa are big worries because of high short term debt. If everyone plays safe, it could lead to a global slowing down in 2016. These and the anxious situation in the ME, Iran’s likelihood of pushing oil into the market, etc. have become a planner’s nightmare. Speculators thrive in such situations. Don’t forget what George Soros did in the 90s. The situation is again ripe for a big punt. Dr Z wistfully said, “Borrowing demand from the future to make the present look better is kicking the can further down the road. That is what China may do to soften its landing in 2016 if things go out of control. Some other countries will try to bolster their economies, by borrowing money to create demand, hoping to repay from future earnings. That is going to be toxic if one depletes the ability to service the debt in the future without more borrowing – a Ponzi game at best. This is an opportunity for a serious move by moneyed speculators to short the economy. I am not saying that the opportunity will be seized but it could be.”

“In the Global Financial Crisis of 2008, some prior warning signals were visible. The KI6 met at short notice because some of them could read some smoke signals.”

How will this affect the Indian economy?

The press was eager to know about implications of all this on India. Dr Z was clear that 2016 would not be a trailblazing year for India though it would be a bright star in a dull global economy. He lightened the atmosphere with a quiz on the likely fastest growing economy in 2016 but disappointed the audience by saying that it would be Turkmenistan and not India. He said, “This is the year in which we need to get global businesses around the world to invest in India and thankfully, Modi had spent the better part of his 20 month reign, marketing India to other countries. Sadly though, the Indian economy is going to do only slightly better in 2016, than it was in 2015. The failed monsoon in 2015 has reduced the spending power of rural India although agriculture per se accounts for hardly 30% of the rural income these days. FMCG companies will continue to hurt for the next few months. We can expect a decent monsoon this year because El Nino would have petered out by then. In fact, for added effect, he said that El Nino is currently at its strongest in recent times, causing the eastern part of the Pacific Ocean to warm up. The California coast is likely to get rains. It is expected to peter out by spring 2016 and if it does, we may have adequate SW monsoon in India. India will do well in the second half of FY 16-17 especially because food inflation will moderate by September, even if it rises earlier.”

Dr Z, the only non- government member of Modi’s team took over and explained that the views he is going to express are his own and not that of the Government.

“The biggest upside for India will be the low oil price. It will have a major impact on the current account balance and the GDP. The other good news is that the Insolvency & Bankruptcy Code 2015 will make a much bigger impact on ease of doing business in India than people realise. It will also make it tough for wilful defaulters and pave the way for more funding of businesses eventually.”

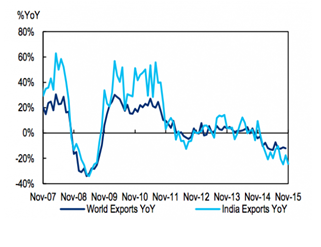

He said, while handing over Table 3, “But the bad news is that India’s exports will be sluggish. Since India’s export basket is mostly comprised of commodities and non-innovative manufactured goods (barring some IT/ITES), India’s international trade is very closely mirrored by global trade trends.”

Trends in exports – India and the World

“We know that global trade will suffer in 2016 and so will India’s exports. Already in 2015, export of several products like petroleum products, gems and jewellery, cotton yarn, fabrics and made-ups, handloom products, electronic goods, plastic and linoleum, spices, fruits & vegetables, handicrafts excluding handmade carpets, oil meals, other cereals, iron ore, tobacco, tea, etc. have been hit. Exports to the GCC in particular will be hit.”

“Further, one should expect dumping of commodities and manufactured goods in 2016, as China, desperately tries to deal with overcapacity and slow growth in its domestic market. The tyre industry in India has been affected in the current year. Cheap imports from China may cross 8 million tyres unless the Government of India acts quickly. The Government is, indeed on the alert on various products being dumped including steel though there are signs that China will cut back on some unproductive and polluting capacity for steel production.

“The quality of asset portfolio of banks, especially some public sector banks, is a concern and the system needs more Tier 1 capital which will be hopefully addressed in the next Budget. The low oil prices and reduced LPG subsidy will give some headroom.

If nothing unusual happens, India should register a real GDP growth of 7.5% +/- 0.2 % in FY 2016-17, and the Rupee could be close to 70 to the US $. ”

One of the journalists asked, “If the Global economy is rocked by speculators who bomb the currency market seeing the opportunity in China’s woes, will India get caught in the maelstrom?”

“If that happens, China, many emerging markets and some European countries will be hit,”, said Dr Z, “Let me assure you that India’s balance sheet is strong, so it will not collapse but its Profit & Loss account is weak, causing it to get hurt when partner countries are hit.

Let me explain. India’s net debt to GDP ratio is hardly 0.65. It can absorb some shocks. External Commercial Borrowings have increased this year but thankfully 39% of it is hedged as opposed to only 15% a year ago. However, India’s revenue to GDP ratio is a dismal 0.3, meaning that the Government is very ineffective in raising revenues despite direct plus indirect tax rates not being low because there are huge inefficiencies and leakages in the system. This makes the fiscal balance vulnerable. Low oil prices will help, as will the possibility of lower gold imports due to some success in the Gold Monetisation Scheme launched some months ago. But gold prices could go up because of economic volatility.”

Borrowing demand from the future to make the present look better is kicking the can further down the road.

Turning to the Prime Minister, he said, “I am hopeful that the Government will deal with some issues like the huge subsidy bill, GST, Bankruptcy Code, the irresponsible bad debts of some big borrowers who hide under the cloak of politicians, etc.”

“Will it be good to invest in equities?” asked another journalist. “I am not a ‘stock-market expert’”, said Dr Z.

“But why would you want to play in such a volatile market unless you are a speculator? Just invest in strong, well governed Indian scrips with a 3 year horizon.”

On being asked whether technology stocks would do well, he proffered. “The 21st century darling, Google, is finally going to become the most valued company in this world in early 2016 by getting past Apple. Both companies are valued upwards of $500 billion.

You should be following many emerging applications of block-chain technology (the underlying technology that makes Bit-Coin possible) which will spawn interesting new opportunities in 2016. You should also follow the trend in crowd sourced debt financing which will in a few years challenge the right of conventional Banks to exist”.

Evading the final question on whether there will be a Big Financial Crisis in 2016, Dr Z quipped, “There is fear of that. Therefore, the KI6 was pressed into action in Kitzbuhel.”